NEAR Wallet

is HERE

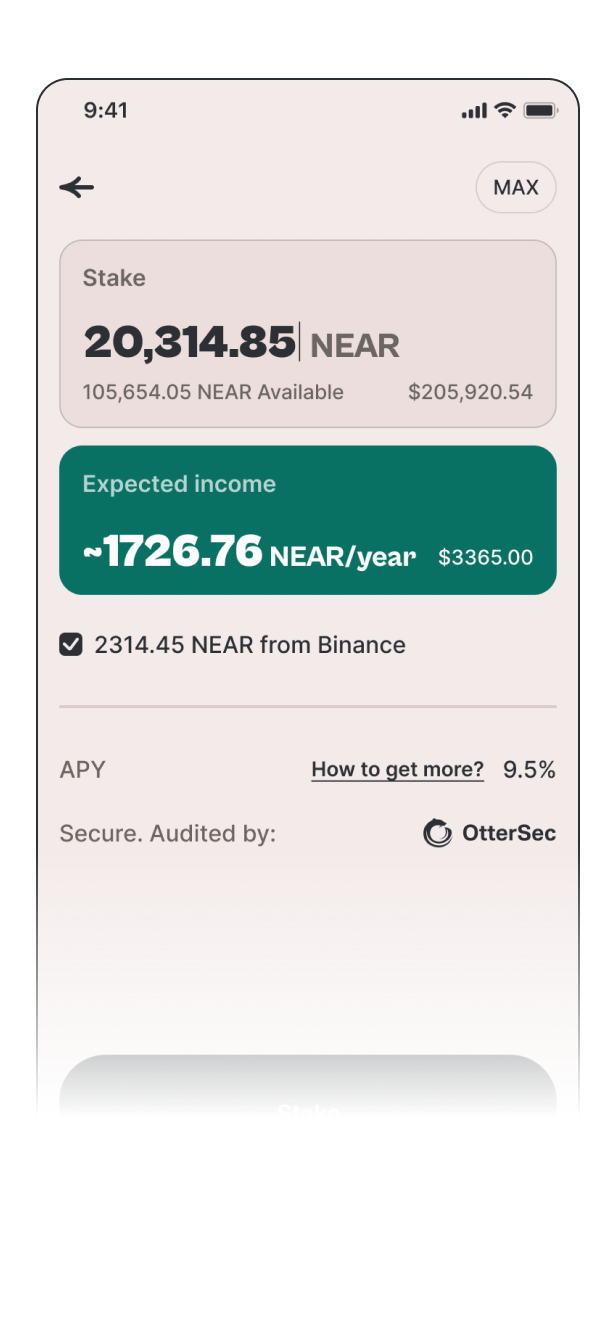

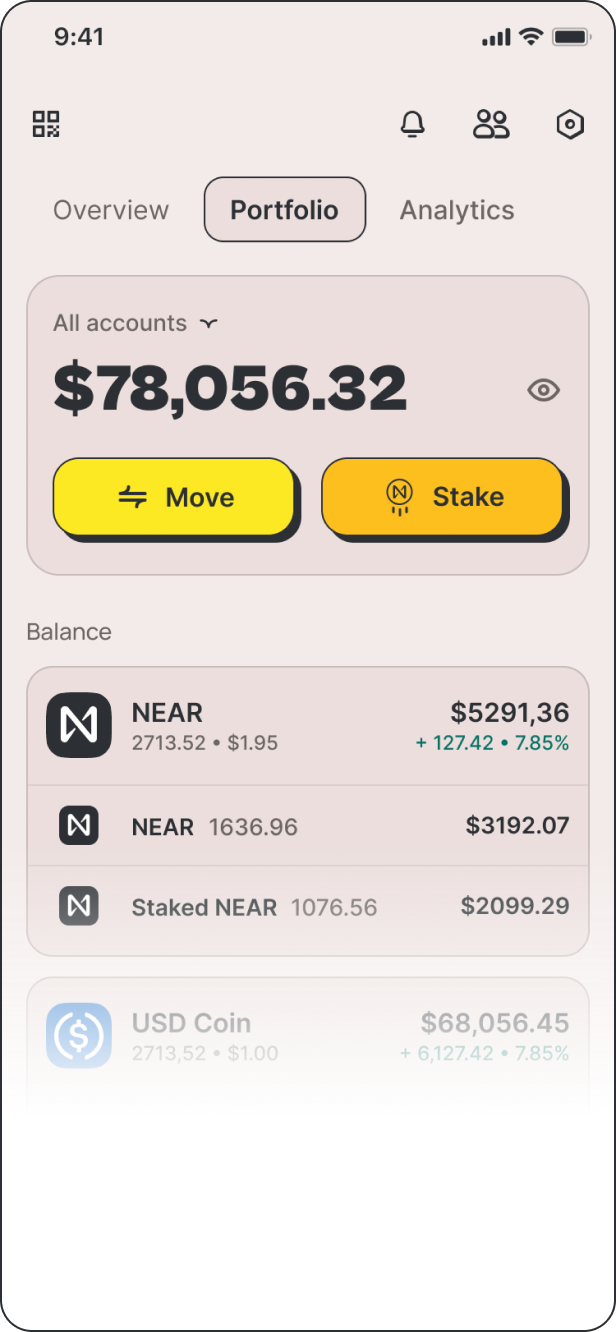

Self-custodial wallet for NEAR Protocol. Build in DEX aggregator, NFTs, non-blocking staking and weekly airdrop

Scan to start HERE

Scan to start HERE

Self-custodial wallet for NEAR Protocol. Build in DEX aggregator, NFTs, non-blocking staking and weekly airdrop

Scan to start HERE

Powered by NEAR Protocol

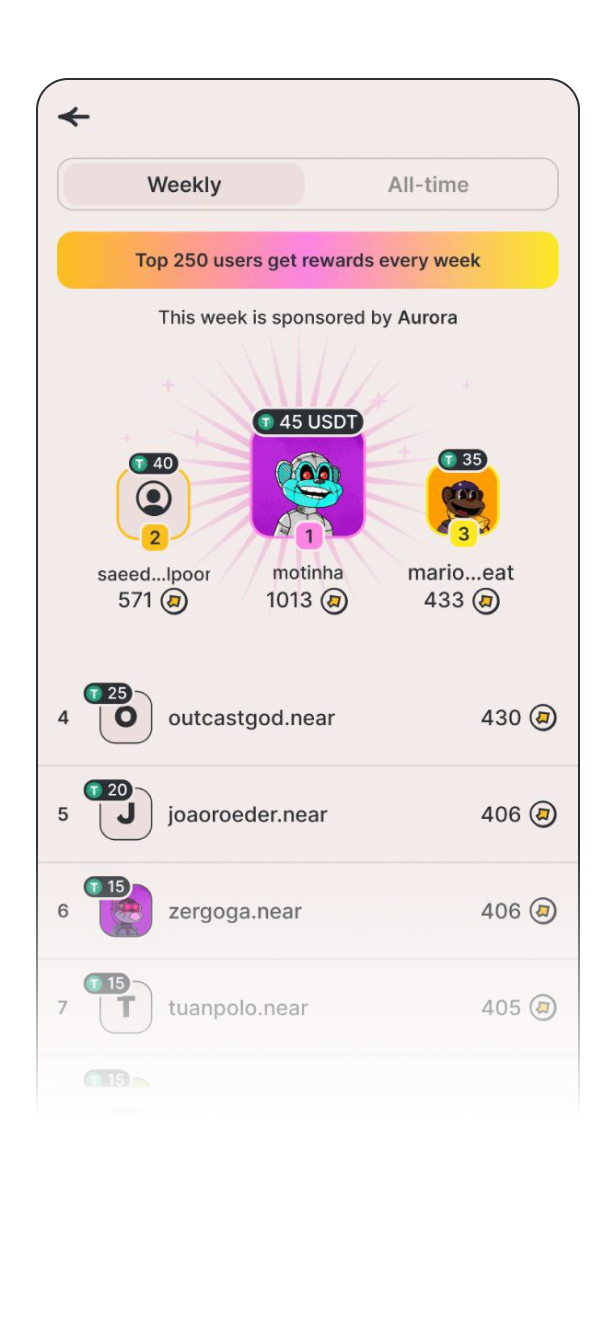

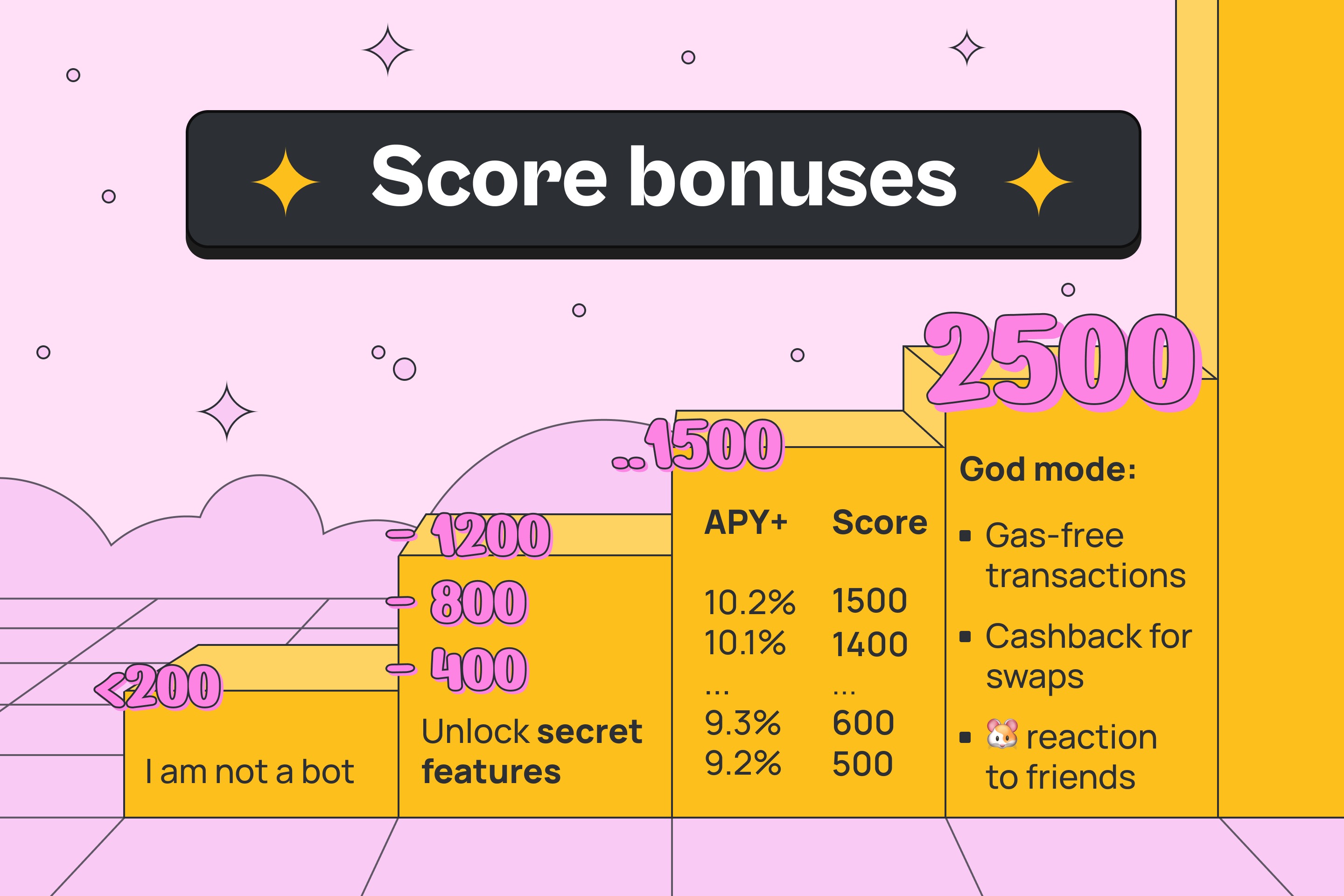

Get a score for using your wallet.

Every week top 100 users by score growth get from 1 to 25$!

Seed phrase stored locally on your device. The app is protected by Face ID and PIN

Connect HITO or Ledger and get ultimate security

By OtterSec

The app checks your actions for safety and warns you of potential risks

😶🏆 Congratulations to the winners and all who participated. It's been a hot season!

We will take a break to prepare a new one, but soon we will launch new activities inside the app!

Winners 👇

Let's break it down:

🔥 cashback for swaps

⚡️ gasless transactions

🐹 special emoji

🆕 Make swap on your Binance account via HERE Wallet

⚡️ It is easy and always in your pocket

💰 Best rate between liquid swap and Binance orderbook

✅ Swap available without VPN everywhere

What is Binance connect?

The idea is to use money from the balance of the exchange onchain. When you connect Binance, you create an api key that lets you quickly move assets between the exchange and your crypto wallet. Now you can remove fees from staking, use dApps, and store money safely. And at the same time use the exchange for cheap swaps and withdrawals to fiat.

How to deposit/withdraw money in HERE Wallet?

You can deposit/withdraw money in any cryptocurrency using card or Binance. Balance in HERE is USDC stablecoin, so you can withdraw it any way you are used to. You can withdraw money to a Binance account or to a bank account.

How long does it take to withdraw money?

We do not block funds and withdraw them within 3-5 seconds after verification. Withdrawal to Binance usually takes one minute, withdrawal to a bank account takes about 12 hours, in rare cases up to three days.

Is Binance connect safe?

We have prepared an article that explains why Binance connect is safe. Take a look: https://medium.com/@...

Why should I connect Binance?

How to cash out money from the wallet?

You can cash out using your nearest USDC exchanger for fiat currency.

How can I report bugs?

You can send bugs to our support in telegram (t.me/heresupport) or to our discord channel https://discord.com/...

Can I change my seed phrase?

Yes. You can change your seed phrase. Go to settings -> passphrase -> generate new passphrase

Leave your near username to get early access to Binance connect

We will notify you once the feature will be unlocked.